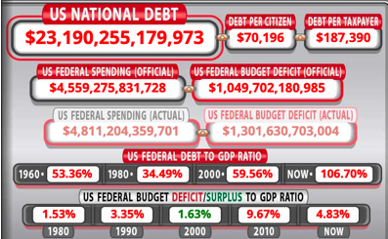

The current U.S. National Debt is standing at $23,190,255,179,973 and rising fast. The Federal Reserve Bank figures indicate that the current debt per citizen is $70,196 and $187,390 per taxpayer. Perhaps the most important indicator is the ratio of Debt/GDP. In the 6 decades since the metrics were measured, U.S. Federal Debt to GDP has increased sharply from 53.36% (1960), to 34.49% (1980), to 59.56% (2000), to 106.70% (2020). From a cursory reading, these stats clearly reflect that the U.S. National Debt is greater the total value of goods and services produced in the country (GDP), resulting in a U.S. Federal Budget deficit of 4.83%. The government debt to GDP ratio hit a record low of 31.80% in 1981, and a record high of 118.90% in 1946. Current statistics are inching towards record high levels.

Source: US Treasury Department

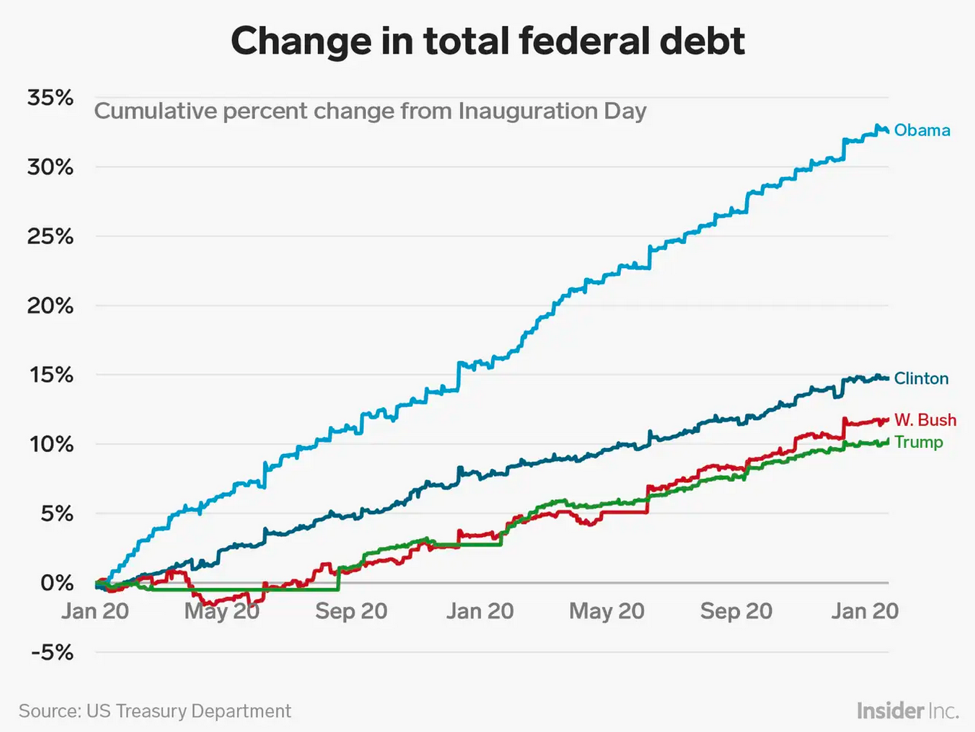

- President Ronald Reagan added $1.86 trillion to the national debt

- President George H.W. Bush added $1.554 trillion to the national debt

- President Bill Clinton added $1.396 trillion to the national debt

- President George W. Bush added $5.849 trillion to the national debt

- President Barack H. Obama added $8.588 trillion to the national debt

- President Donald J. Trump is expected to add $5.088 trillion to the national debt by the end of his first term (+/-).

Clearly, the national debt is increasing at an unprecedented rate and it appears to be a runaway train that no administration is capable of reining in. Sound economic theory states that the only way to reverse this alarming trend is to generate more revenue and reduce expenditure, or simply to cut costs while maintaining healthy economic growth.

Given that increasing demands are placed on government, owing to population growth, military expenditure, Social Security, Medicare, unemployment benefits, and inflationary pressures, it is unlikely that the US national debt will reverse course. This naturally leads to out-of-the-box thinking or inventive ways to pay down the national debt, including federal regulation of online gambling activities. The question as to what type of online gambling may stand a better chance of contributing towards debt repayment, or at the very least adding to state coffers, invariably leads to a question of skill-based games vs traditional gambling games. Backgammon, chess, and Bridge are considered games of skill, and many poker players believe likewise. The PPA (Poker Players Alliance) has lobbied Congress to accept poker as a game of skill, and not a game of chance. The jury is out on whether the argument can gain traction in the mainstream, but several states have already adopted regulations to approve online poker play. These include Delaware, Nevada, New Jersey, and Pennsylvania. Pending online poker regulations in multiple other US states are underway too. Regardless of the track – skill-based gambling games or regular games of chance a careful evaluation of the numbers is needed to evaluate the efficacy of using online casino and online poker revenues to pay down the national debt.

How Much Money Is Generated through Gambling Annually in the United States?

The gross gaming revenue (GGR) of casinos in the US in 2018 were listed by state on the premier stats portal, Statista. According to the data, the following 2018 figures were reported:

- Nevada – $11.917 billion

- Pennsylvania – $3.251 billion

- New Jersey – $2.9 billion

- New York – $2.587 billion

- Louisiana – $2.561 billion

- Indiana – $2.240 billion

- Mississippi – $2.142 billion

- Ohio – $1.863 billion

- Missouri – $1.754 billion

- Maryland – $1.746 billion

- Iowa – $1.467 billion

- Michigan – $1.444 billion

- Illinois – $1.373 billion

- Colorado – $842 million

- Rhode Island – $656 million

- West Virginia – $623 million

- Florida – $569 million

- Delaware – $432 million

- Kansas – $408 million

- Massachusetts – $273 million

- New Mexico – $235 million

- Main – $143 million

- Oklahoma – $139 million

- South Dakota – $106 million

In total, the revenue generated by US casinos in 2018 amounted to $41,684,000,000. That’s $41.684 billion, or 0.17974 % of the US National Debt. Think about that for a second; the total U.S. gambling revenue from 2018 would need to be multiplied by 556 times in order to pay down the U.S. National Debt. That means it would take 556 years of annual GGR to pay off the US national debt as at January 2020.

If the US does not add $1 more in debt over the next 556 years, and the government seizes 100% of GGR generated by casinos, leading them to bankruptcy within one year, the national debt could theoretically be repaid, but that in itself is an impossible situation. First of all, if the government seized all gross gambling revenue of casinos at current GGR figures over the next 556 years, those casinos would shut down within the first year of operations and national debt would spiral out of control, unemployment would skyrocket, and economy would tank. Clearly, it is impossible for any amount of taxation to rely solely on gambling revenues to pay down the national debt.

Could Regulation of Online Gambling Pay down the National Debt?

We have just established that land-based casino gambling revenues would have to be seized in their entirety for 556 years to pay down the current national debt. That’s not going to happen. So now, we turn our attention to online gambling to determine how much that can generate for the government. In 2017 gross revenues generated through legal US online gambling activity amounted to $247.5 million. $247.5 million divided by $23.190 trillion equals 0.00106%. At that rate, it would take 943.4 years with all proceeds (every cent) from online gambling going towards the U.S. National Debt in order to pay off the $23.190 trillion currently owed.

Clearly this is an impossible situation since the national debt will be ‘substantially’ larger as time progresses, and 1000 years into the future, the planet may not even be here. The prospect of relying on online gambling revenues to pay down the U.S. National Debt is the most hypothetical scenario imaginable; there is more likelihood of planet Earth being struck by a superflare, comet, asteroid, or life-threatening extinction event. In such a scenario, there is no point focusing on repaying national debt.

In 2018, US online gambling revenues rose substantially to $306.5 million, and if we take the total gross revenues from the entire US gambling industry in 2018, it generated $161.24 billion – still a drop in the bucket compared to the U.S. National Debt. The commercial casino industry is certainly a vibrant spoke in the economic wheel, but it pales in comparison to the sheer size of the U.S. National Debt. It will take a lot more than the online gaming industry and nationwide regulation in every state to make a dent in the debt. That’s a gamble that everybody is 100% certain will not pay off.

Add Comment