Specialized sales agents need specialized tools in order to do their job at their full potential. This is why mortgage broker software was developed. This broker CRM software solution helps both lenders and borrowers establish strong relations and exchange documents in order to do business safely. But because there are a lot of options out there, some people might need some help choosing the right solution for their business.

Knowing How Broker CRM Software Works

When people talk about sales they are referring to a very wide area of activities. One of these activities is mortgages. As with any product or service from any other field, mortgages can be considered services that are being offered by various financial and non-financial institutions to people that seek them. And, as any other area of sales, the people “selling” mortgages need some very specific tools in order to do their jobs properly. For instance, they need Customer Relationship Manager software, or CRM for short. And because a mortgage is probably one of the biggest financial decisions anyone can ever make in their live time, the people selling them need customized tools to be able to engage potential customers successfully.

The first thing that a mortgage broker has to understand is that the customer is going through some serious emotional distress during this process. This isn’t a decision anyone takes lightly. This is why the customer needs someone who he can trust. This is where the broker CRM software come into play. The software has been developed and refined over the years in order to help both broker and customer reach common ground easily and without any hassle on any part. The system is devised to anticipate and answer various demands that the parties might have in order to help them develop a relationship that will enable them to do business together.

How Can Broker CRM Software Help?

The trust has to be mutual. This is why broker CRM software is designed to gather information about a client and keep it on file and at hand for the broker to examine whenever he wants. This information may include, but is not limited to, payment history, financial background checks, risk assessments and even personal details such as date of birth, personal preferences that the customer might have shared along the way etc. The CRM software collects all of this information and stores it so that nothing is lost. Knowing all of this, the broker can easily establish a relationship with the customer and help him better cope with any stressful moments they may encounter during the process.

One of the best things that broker CRM software does is cut overhead costs regarding communication. A lot of CRM platforms come with integrated capabilities that include phone, e-mail, messaging and other. This really comes in handy when you need to get a hold of your lead but don’t want to spend a fortune on the phone bill. A feature like this can really come in handy when trying to choose between communication carries and different plans. Also, this feature comes in handy when reaching out to older clients, keeping in touch, letting them know that they matter to you and that they can anytime can do business with you again. Not to mention that the software can help any broker keep track of lead birthdays and even send out pre-prepared messages for special occasions.

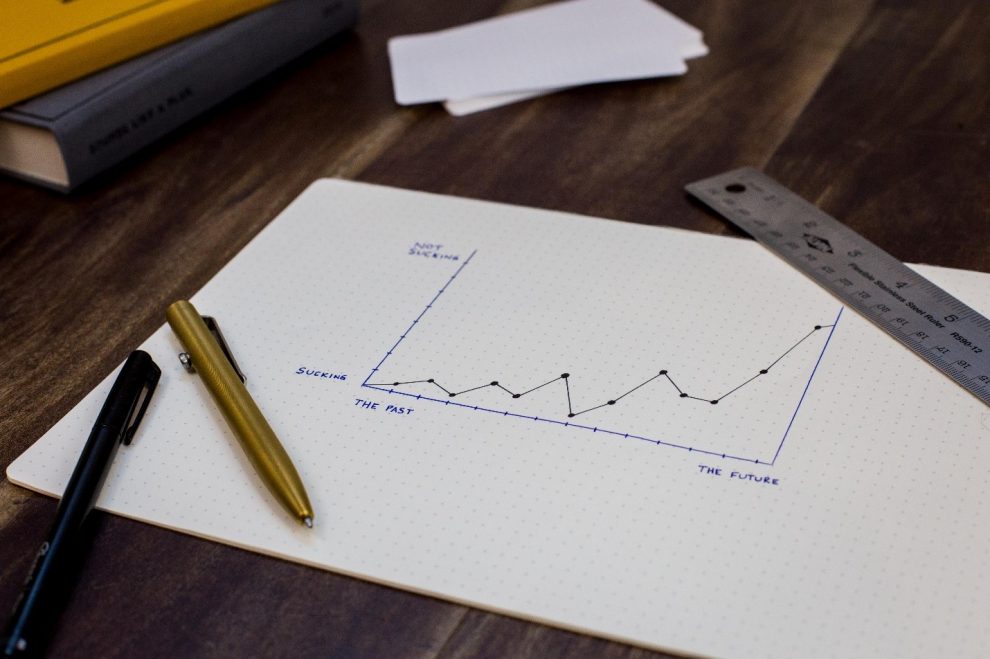

The software also comes in handy when management wants to take a closer look and see who is doing what and how. The system generates detailed reports regarding each sales agent and each sale, thusly being able to identify the strong and weak points of a team and help in developing best practices guides and improving sales techniques. Also, any team leader can access the complete archive of any customer that has ever entered the system, which can really be helpful when trying to build customer profiles or better understand certain patterns in behavior.

Who Is Mortgage Broker Software Designed for?

As the name says, the mortgage broker software is specifically designed to be used by mortgage brokers in order to help them interact with customers and leads. The software is created so that communication between parties is done more easily right up to the point where certain aspects of it can be fully automatized. Celebratory e-mail or various messages can be programmed into the mortgage brokering software and it simply does the rest, freeing the broker to do something more constructive with his time. It may not seem like much at first, but when you have a sprawling portfolio, each minute you can save from writing e-mail add up.

But the mortgage software isn’t designed to help only the broker. It has been thought out as a way of helping the customer too. For instance, some of these software solutions come with digital signature capabilities. This comes in extremely handy when meeting leads out of the office or sending important documents back and forth and having to sign them in a rush. Another way this software can help customers is through the billing and invoicing features. Clients can be automatically reminded via text message or e-mail when a payment is due or how much is left to pay. And the best thing is that the broker gets an exact copy of the message without having to lift a finger.

How to Find the Right Mortgage Broker Software for Your Business?

Finding the right tools for your sales team may seem like a daunting challenge sometimes. Mainly because there are so many options out there. Choosing the right one out of them can be sometimes a very hard decision to make. But there are always a few ways of making sure you chose the right one at the end of the day. Firstly, get to know what is out there. Do your research on more than one mortgage broker software solution. There are plenty of forums and blogs out there that can help you get an idea about what other people are using and why. Also, if you’re still not sure, you can always send an e-mail to whatever developer you like asking him whatever you want. Some of them even offer free trials for their software in order to help potential customers make up their mind and familiarize themselves with the services they offer.

Secondly, you should make a list of what kind of features you want your mortgage broker software to have. You can then start checking off the list the ones that don’t meet your requirements. As soon as you establish what exactly it is you want your software solution to do for you, you can start actually looking for something concrete. And also, always remember never to jump into something head first before taking your time and doing some serious research.

Add Comment