This post will explain Greenlight debit card alternatives. If you’re assuming getting a debit card for your kid, you might be wondering what your options are. Among the most popular choices, the Greenlight debit card, can help kids learn to earn, save, provide and invest. Although Greenlight is a leading choice for lots of parents who are searching for debit cards for kids, you do have other choices. Lots of Greenlight debit card alternatives have most or all of the very same functions.

10 Best Greenlight Debit Card Alternatives In 2022

In this article, you can know about Greenlight debit card alternatives here are the details below;

We’ve discovered the best Greenlight alternatives to help you teach your kids money management habits that will set them up for financial success.

When it comes to children debit cards, you’ll want to pick a card that fits your household’s requirements and spending plan.

In order, here are the very best choices to the Greenlight debit card.

1. Acorns Family

Acorns is usually known for their adult accounts that permit you to buy fractional shares of stock using roundups from linked debit and credit card purchases.

You can open an Acorns bank account and make purchases with your Acorns debit card. This costs simply $3 per month

What you do not know is that Acorns Family is readily available to families with kids. When you open an Acorns Household represent $5 per month, you get financial investment accounts for unrestricted kids. Also check Supply chain management software

Better yet, this account comes withretirement,investment and inspecting accounts in addition to bonus offer investments, money-related guidance and a lot more.

Keep in mind that with Acorns, there’s no straightforward debit card for your child. Nevertheless, you can allow your child to make purchases by setting up an Acorns bank account in your name.

but you will have to be with your kids when they make purchases.

Rate: $5 monthly.

Pros

– Six ETF portfolios to choose from

– Invest for both grownups and kids

– Sensible monthly cost

Cons

– No targeted debit card for kids

– No choice for an education financial investment account

2. Axosbank

The Axos First Bank account is developed for kids aged 13-17. Teenager account owners should have a joint adult account owner.

The account features a totally free debit card that is fee-free as long as you are utilizing in-network ATMs. You can likewise get up to $12 in ATM fee reimbursements every month.

Other features of the Axos First Bank account include:

-$ 0 minimum balance requirement

-$ 50 minimum opening deposit

-$ 0 monthly service charge

-$ 100 daily ATM limitation/$ 500 day-to-day purchase limit

– Real-time activity notices

– Interest-bearing.

Parents can manage debit card gain access to utilizing the app or website. Kids can make peer-to-peer transfers and benefit from Axos’ recommendation program.

Biometric recognition and bill pay are likewise available with this account. See the Axos site for more details.

Cost: $0 each month.

Pros.

– Interest-bearing account.

– Expansive parental controls.

– No overdraft costs.

Cons.

– Minimal ATM fee reimbursements.

– Lower debit card limitations than other cards.

3. BusyKid.

BusyKid is a prepaid invest card that assists your kids generate income by doing assigned tasks.

As a moms and dad, you can use the app to designate preset chore choices. The money in your child’s account can be invested anywhere Visa is accepted.

Alternately, you can deal with your kid to save the cash in a cost savings pod, invest it in shares of stock or donate it to a charitable organization.

Other features consist of:.

– The alternative for parent-directed benefits.

– Loved ones can send cash to the account through QR code.

– Parental match feature on savings pods.

– Multi-parent gain access to.

You can add up to 5 kids to your BusyKid account. Remember that there is a $0.50 charge for each declined purchase (due to insufficient funds).

Likewise, it is very important to keep in mind that you will get charged $7.99 for each replacement card.

You can fill funds onto the card, which can be used anywhere you would usually utilize a Visa debit card. Plus, you can move funds from the card when appropriate.

Price: $3.98+ per month or $38.99 each year.

Pros.

– Appealing prices alternatives.

– Friends and family can contribute to accounts.

– Comprehensive parental control alternatives.

Cons.

– Substantial card replacement fee.

4. Chase First Banking.

The Chase First Banking account is for teenagers ages 6 to 17. This account includes a task app along with a savings function.

Moms and dads can select just how much a child can invest per transaction and where. For example, you might set a $10 limit at dining establishments or a $20 limit across all categories.

Other functions include:.

-$ 0 regular monthly charge.

-$ 0 minimum opening deposit.

– Free ATM withdrawals at Chase ATMs.

– Real-time spending informs.

Kids can even ask for money transfers through the app, which parents can pick to accept or decline.

As the moms and dad, you need to have or open a Chase checking account in order for your kid to have a Chase First Banking account.

Approximately 5 Chase First Banking accounts are enabled per parent or guardian.

Price: $0 per month.

Pros.

– Set automatic allowances and/or make a chores list.

– Ample adjustable adult controls.

– No costs.

Cons.

– Moms and dads must have a Chase account.

– No direct deposit permitted.

5. Copper Teenager Banking.

Copper Banking is a fintech business that has accounts for adults. Nevertheless, each adult account holder can open to five Copper Teen accounts.

You can money your Copper account by moving money from your bank account or your debit card. Then, you can move money to any Copper Teen account.

Other Copper Banking functions consist of:.

-$ 0 minimum balance requirement.

– Automated allowance payments.

– Direct Deposit abilities.

– Financial education tools.

– Savings goals feature.

Your teenager does need to have their own cell phone in order to use Copper. That might be a drawback for some parents.

Price: $0 monthly.

Pros.

– Absolutely no account fees.

– Large fee-free ATM network.

– Get up to 5 teen accounts with one adult account.

Cons.

– Minimal adult controls.

– Teens must have a cellular phone to use.

6. Existing.

Present is a fintech banking app developed to assist kids and teenagers find out about earning, costs, saving and providing.

When you open a Bank account, you can add a teen account for your kid. Teenager accounts through Existing cost $36 per year.

As the parent, you have authority over transfers to the account. You can set spending limitations and ATM limits also.

Other features include:.

-$ 0 opening deposit requirement.

-$ 0 minimum balance.

– Fee-free in-network ATM withdrawals.

– Task list capabilities.

– One cost savings pod.

– One providing pod.

Offering pods enable your teenager to contribute money to a charity of their preference. You can set weekly allowances, make one off transfers or assist your child make via the chore list. Also check best business management software

Cost: $36 annually.

Pros.

– Free parent account available.

– Flexible and appropriate parental controls.

– Direct Deposit readily available.

Cons.

– Yearly fee applies.

– Only one guardian allowed.

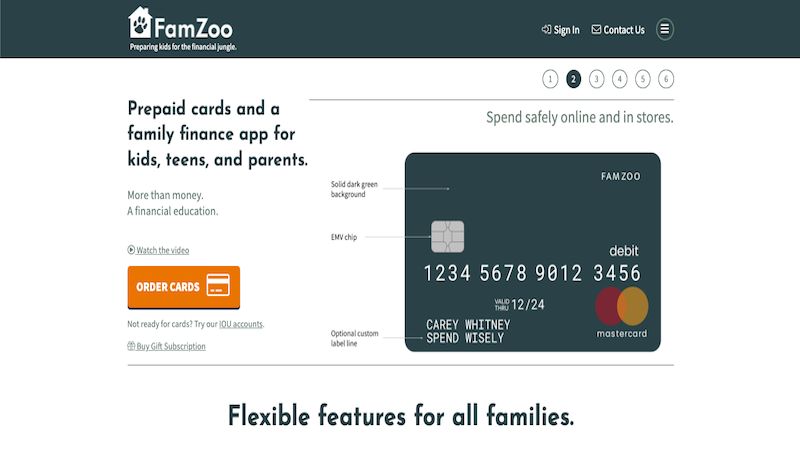

7. FamZoo.

FamZoo is a household banking fintech developed to assist you teach your kids about finances. You can select from two types of accounts, an IOU account or a pre-paid account.

A pre-paid account, whether a costs, conserving or giving account, holds actual cash. IOU accounts are accounts you will use to track the money you owe your child.

You can pick whether to utilize IOU accounts, pre-paid accounts or a mix of the two. Additionally, you can utilize the app to set up everyday and weekly tasks.

Kids earn their cash (or you give them a weekly allowance), and then they work with you to choose how to invest, conserve and give.

Other functions of FamZoo consist of:.

– Full parental controls.

– Activity informs.

– Parent-paid interest alternative.

– The ability to include rewards or charges.

The benefits and charges option is a good touch for moms and dads who wish to reward their children for going above and beyond or penalize them for not following the guidelines.

Keep in mind that you can save money on the month-to-month cost by paying semi-annually, annually or bi-annually.

Cost: $5.99 per month.

Pros.

– Comprehensive mentor tools.

– Rewards and penalties functions.

– Versatile parental controls and functions.

Cons.

– No complimentary option.

– Learning curve is a little challenging.

8. GoHenry.

GoHenry is a fintech banking application with a debit card for kids ages 6 to 17. With GoHenry, you can develop weekly allowances and/or set up task lists.

Your child’s incomes can remain in a costs account, get moved to savings or they can offer some cash to Boys & Girls Clubs of America.

Some features of the GoHenry debit card consist of:.

-$ 0 minimum balance.

– Real-time spending alerts.

– Adult spending controls.

– Direct Deposit capabilities.

Note that GoHenry has a detailed learning center that is ideal for providing kids additional understanding about cash. Classes in the learning center are free.

Teens can likewise send out and get payments from other GoHenry members. This is a terrific function to have if your teenager wishes to divide a lunch expense or other expenditure with a good friend.

Keep in mind that your teenager will not have the ability to utilize the “pay at the pump” feature with GoHenry. Nevertheless, they can spend for gas inside the gas station.

Rate: $3.99 each month.

Pros.

– Comprehensive finding out center.

– Recommendation reward program.

Cons.

– No complimentary choices.

– Extra limits on debit card costs.

9. M1 Financing.

M1 Finance is a fintech company that permits grownups to spend, conserve, obtain and invest. With M1 Finance, you can open a UTMA/UGMA custodial account for your kid.

The business has a routine account that’s free. Nevertheless, you require to open the Plus account for $125 annually in order to be able to produce a represent your kid. Also check graphic design software solutions

If you use the debit card feature to invest some of the cash from the custodial account, the cash must be utilized for the direct advantage of the minor kid.

All of the money will be moved to the child’s ownership once they reach legal age. This varies based upon the state you live in.

One nice feature of choosing M1 Financing over other options is that you can buy fractional shares of stocks and ETFs for your kid.

Other features include:.

– 1% money back on debit card purchases.

– Approximately 4 regular monthly ATM fee repayments.

-$ 0 minimum account balance.

– No charges on worldwide debit purchases.

M1 Financing is tailored particularly for moms and dads who are interested in spending for their children’s behalf. The debit card is a secondary function.

You can create your own portfolio or utilize among M1 Financing’s custom portfolios.

Price: $125 annually.

Pros.

– Attractive financial investment functions.

– Money back on debit spending for Plus members.

– Custodial UTMA/UGMA accounts are readily available.

Cons.

– Hefty yearly cost (relatively).

– Not tailored straight toward kids.

10. Mazoola.

Mazoola is a household digital wallet that you can use to pay kids for tasks.Now, you can help them manage their cash, whether that be saving, spending or setting monetary goals.

Some functions of Mazoola consist of:.

– Moms and dads can set limitations on dollar quantities and authorize merchants.

-$ 0 minimum balance.

– Tasks feature.

– Goals feature.

– Charitable contributions alternative.

– Real-time activity notices.

Although the subscription cost is a bit pricy, Mazoola does offer a 1 year complimentary trial.

Cost: $9.99 each month.

Pros.

– Sufficient adult controls.

-” Stealable” chores.

– Apple Pay and Google Pay suitable.

Cons.

– No physical debit cards.

– Additional costs not disclosed on the site.

Summary.

The best Greenlight alternatives will help your kid discover to save, invest, invest and likewise find methods to generate income as a teenager. That way, they’ll be prepared when it comes time to leave the nest.

Put in the time to understand which functions are essential to you. Then, review the offerings and expenses of each alternative to choose whether Greenlight or another card is best for you.

Add Comment