Best Quicken Alternatives will be described in this article. Some of the links in this piece might be affiliate links, which means that, at no extra cost to you, if you click through and buy something or sign up for something, I get paid. I only offer recommendations for goods and services that I, first, believe in and, second, would give my mother. This story was not controlled by, influenced by, or contributed to by advertisers, and it never will be.

Before, Quicken was the standard instrument for budgeting. When it first came out in the 1980s, I used it. Apps that allow you to manage every part of your finances today have supplanted it, often for no cost. Here are the top Quicken alternatives to think about as 2023 draws closer. Three stand out among the remainder of the alternatives to Quicken (and Mint, for that matter):

Personal Capital-Now known as the Empower Personal Dashboard (Empower acquired Personal Capital 2020), it is still available for free and offers an extensive feature set that is unmatched by competing alternatives. Budgeting, net worth, financial flow, retirement investments, and taxable investments are all handled with ease. A retirement calculator, investment fee analyzer, and investment portfolio analyzer are just a few of the superb tools included. Even Bitcoin, Ethereum, Litecoin, and hundreds of other tokens can now be tracked by Personal Capital. I use it on a daily basis.

Tiller–Tiller is the solution for spreadsheet aficionados. Your bank accounts and credit cards can be connected, and it works with Google Sheets. Additionally, it provides daily email updates for tracking your expenditures. It costs $79 a year after a 30-day complimentary trial. I’ve loved using it for the past two years.

YNAB (You Need a Budget) is the best option for people who want to concentrate solely on spending (no investments). Its community is unmatched, and it performs budgeting better than any other software on the market right now. I used YNAB for years, but I no longer do so because I no longer find it to be a useful instrument for budgeting.

Top 12 Best And Official Quicken Alternatives for 2023

In this article, you can know about Top 12 Official Quicken Alternatives for 2023 here are the details below;

1. Personal Capital

When looking for a Quicken replacement, Empower comes out on top. It provides tools to manage every part of your finances and is free. You can connect nearly all of your financial accounts, including checking, savings, credit cards, HSAs, retirement accounts, investment accounts, and even your home, with Empower. (via Zillow).

Once connected, Empower’s financial dashboard provides insightful information about your money. The application, for instance, allows you to:

- Maintain a spending log by type

- Determine your retirement age and the expense of your investments.

- View your portfolio’s asset split

- Create a statement of net value.

- Receive reminders when payments are due.

- Review your financial holdings.

- Putting money aside for situations

Without granting others access to your crypto wallet, you can follow Bitcoin, Ethereum, Litecoin, and thousands of other currencies. For years, I’ve used Empower. It’s the only choice that, in my view, can manage every aspect of my finances, including planning for retirement, investing, and setting up a budget.

2. Tiller Money-Best Spreadsheet Budget Tool

Tiller Money has discovered a way to transform a Google Sheet into a dynamic planning tool; I have no idea how they do it. Tiller’s Google Sheet tool lets you connect your bank and credit card accounts, and it will download all of your transactions automatically. You can then generate reports, categorize spending, and establish budgets.

I’ve been using Tiller for my personal and small company budgets for about two years now. For those who enjoy dealing with spreadsheets, Tiller is perfect. I should warn you that installing Tiller can be challenging. The good news is that each stage can be demonstrated in a video. You can accomplish anything if I can.

One thing to remember is that each transaction must be carefully classified. This is a deal breaker for some people. They desire the comfort that comes with automated instruments like Personal Capital. Others would rather classify deals on their own. It makes them examine each entry, consider their financial decisions, and then classify their costs appropriately. You can use Tiller’s auto-categorization tool to classify transactions instantly based on their descriptions.

You can export your transactions to an Excel spreadsheet using Tiller. For those who don’t want to store their banking information in the cloud, this strategy is perfect. Here, there is neither right nor evil. Depends on personal taste. A 30-day free tryout is provided. Tiller costs $79 per year after that.

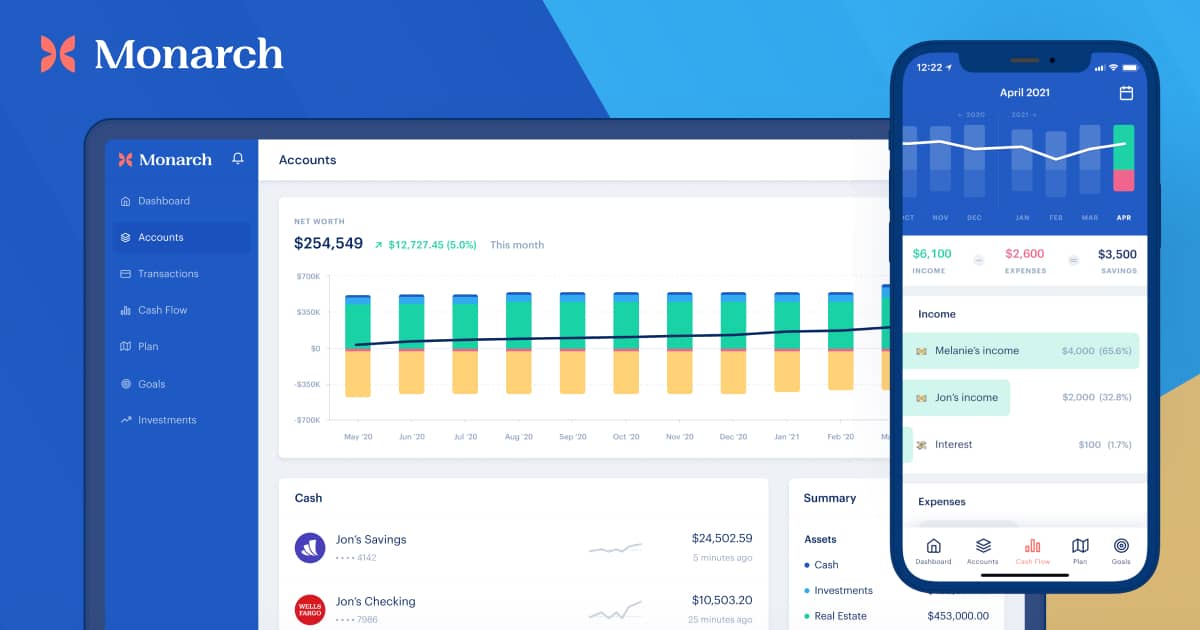

3. Monarch Money-Best for Couples

Many of the functions in the aforementioned apps are also present in Monarch Money. All of your accounts, including those for loans and investments, can be connected. Once you’re linked up, Monarch synchronizes your accounts to calculate your net value. You can use the app to establish financial goals, view all of your transactions in one location, and personalize your financial dashboard.

Because of its collaborative characteristics, Monarch is perfect for relationships. Invite someone to use a different password to access your Monarch account. They have access to your info and can link their personal accounts. Couples who maintain separate accounts but wish to comprehend their overall financial situation will find this function to be especially helpful.

4. You Need a Budget (YNAB)-Best for Budgeting

If you’re just searching for a budgeting tool, YNAB is perfect. There is, in my opinion, no better app available for making budgets. The YNAB UI resembles a spreadsheet. Using the tool, you can easily create a budget for each area based on the funds you actually have. Also check Slack productivity tips

YNAB is a Quicken substitute for planning. Giving every dollar a task is one of YNAB’s guiding principles. By planning out how you’ll spend each dollar that comes into your bank account, you can achieve this. You can link your financial accounts and credit cards to YNAB just like you can with other tools. This enables real-time updates so you can keep tabs on your expenditures all month long.

The extensive feature package that Personal Capital offers is not available in YNAB. This is especially obvious when it comes to spending. YNAB is an excellent choice for those who don’t want to track their investments, though.

But it costs money. For 34 days, you can use it for free. After that, the monthly plan costs $14.99, or $99 for the yearly plan. The greatest drawback of YNAB is the price.

5. PocketSmith-Best for Calendar Budgeting

Initially, PocketSmith was just a calendar for scheduling future income and expenses. It now functions as a complete budgeting tool. With PocketSmith, you can synchronize your accounts. You can monitor your spending and your net worth once everything is synced. Additionally, you can examine your income and expenses in a convenient calendar view.

The auto-budget utility in PocketSmith is a standout feature. It can help you establish a budget based on your previous spending. Additionally, it has a financial flow feature that displays income and expenditures by time period.

Although PocketSmith has a free edition, it necessitates manual data entry. You must pay at least $9.95 per month, or $7.50 per month if paid yearly, to receive automatic bank fees.

6. CountAbout-Imports from Quicken or Mint

CountAbout might be the right budgeting instrument for you if you have a lot of data in Quicken (or Mint). You can import data from Quicken or Mint using a function that is included in it. You can import transactions from your bank and create custom revenue and expense categories using CountAbout. Even images of receipts can be added to expense deals. You can create money reports and schedule repeating transactions.

The price is very fair given the characteristics you receive. the minimal package is only $9.99 per year. (not a month). The annual fee is $39.99 if you want bank activities automatically downloaded.

7. Moneydance-Traditional Budgeting Software

With so many applications appearing online, Moneydance adopts a unique strategy. Instead of using Moneydance software online, you obtain it. Once launched, the program performs largely as you would anticipate.

Bill payment can be started after downloading banking activities into the software. Based on how you categorize expenditures, the software does so automatically. In other terms, it picks up new information as you use the program.

It provides a dashboard (as seen above) that compiles all of your financial information in one location. In order to offer you a visual understanding of your finances, it can also produce reports and graphs. It includes a mobile app, has financial tracking capabilities, and can notify you when expenses are due. It is accessible for Windows and Mac and costs $49.99.

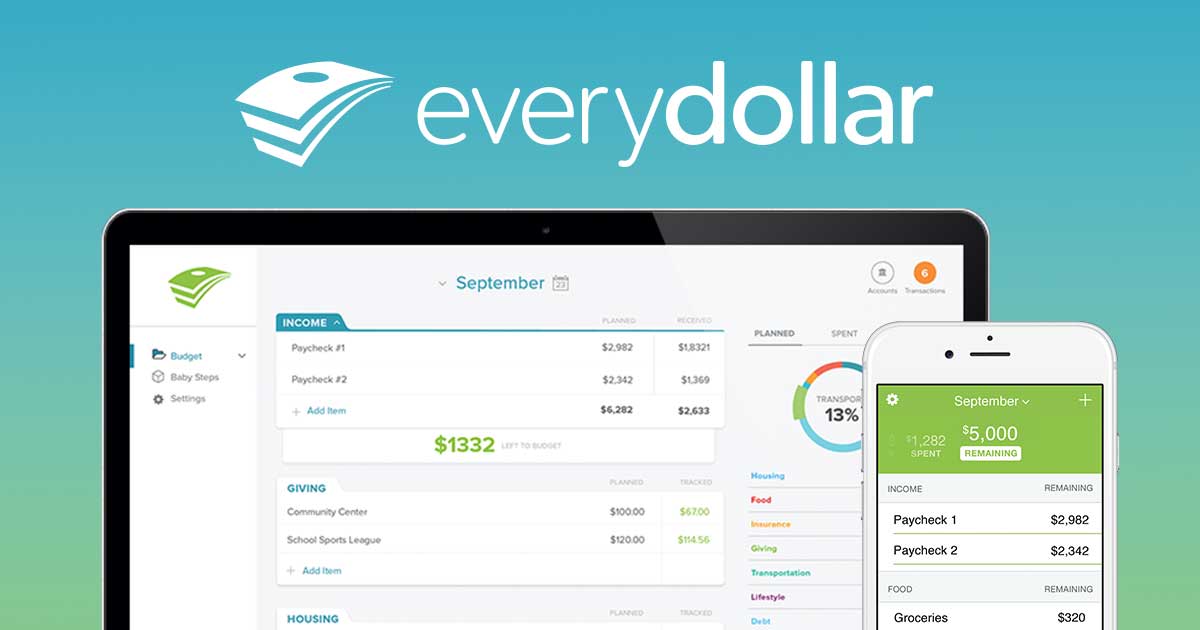

8. EveryDollar

For those of you who are fanatics of Dave Ramsey, EveryDollar could be a suitable alternative to Intuit’s Quicken. It should be noted right away that EveryDollar isn’t inexpensive. You’ll spend $99.99 annually after a 14-day trial (instead of $129.99). The price is $12,99 per month if you choose to pay on a monthly basis. It’s not at the top of my ranking because of this. I am aware that some people are extremely committed to Financial Peace University.

With the tool, you can create budgets, monitor spending, and sync your bank accounts. The budgeting software is compatible with tablets, smartphones, and computers. It also includes Dave’s educational resources, allowing you to enroll in online classes and participate in virtual communities.

9. Banktivity-designed for Macs only

The dedicated Mac budgeting tool is called Banktivity. It has tools that make it possible for you to manage and keep track of all of your money. Accounts and data can be grouped, and you can arrange the dashboard however you like.

With Banktivity, you can stick to an envelope budget. For those who depend on their income every month, this may be perfect.

You can sync data between all of your Mac devices and integrate transactions from your bank. Banktivity also provides account-level statistics and investment tracking. For 30 days, Banktivity is available for unrestricted use. Following that, they provide three plans with monthly prices varying from $4.16 to $8.33. (billed annually).

10. GnuCash-Best for Small Businesses

GnuCash might be the solution for those who used Quicken to track their company income and expenses but were hesitant to upgrade to Quickbooks. For businesses and accounting nerds like me, it employs double-entry accounting, which is perfect. It produces reports and graphs, plans transactions, and keeps track of assets. Also check How To Lead Hybrid Teams

11. Mint-Best Mobile App

When Mint first launched, more than ten years ago, I used it. Numerous of the apps on this list are among the alternatives to Mint that people are searching for today. However, Mint should be taken into account if Quicken from Intuit is being replaced. To start, it is free. Linking your accounts and keeping track of your expenditures is simple. It has a credit score tracker and a spending planner. Of course, there are excellent Mint alternatives as well.

12. GoodBudget-Best for Envelope Budgeting

I was around when the envelope system of planning was popular. My grandmother employed it. We ceased visiting the grocery store until payday when the money in the grocery envelope ran out. (seriously). The envelope budget is still a wise method for people who live paycheck to paycheck to manage their finances today. Give GoodBudget a try if you want a digital form of the tried-and-true budgeting method.

The envelope method is the foundation of the app Goodudget. Your budget can be synced, shared, and goals for saving up for major purchases can be established. It also includes instruments that enable you to monitor and settle your debt.

FAQs for Quicken Alternatives

Which free Quicken option is the best?

The greatest alternative to Quicken that is free is Personal Capital (Empower). Nearly all of Quicken’s features are included, along with money management tools. It’s best suitable for people who want to manage all of their finances, including investments, in one location.

Is Quicken accessible without a membership?

A sad no. Quicken is currently only accessible as a membership, like so many other software programs and applications. As a consequence, Quicken costs money each year.

Which choice is best for moving Quicken data to a new app?

CountAbout is a good choice if you want to transfer Quicken data to a new budgeting software. Users can transfer data from Quicken or Mint using its features.

What calendar planning program compares favorably to Quicken?

Given that it provides a calendar view of your budget, PocketSmith is a wise option.

Which Quicken alternatives let you plan out when you want to settle your bills?

Future utility payments can be scheduled using YNAB and Tiller Money. You can allocate money to expenses you intend to pay in the future using YNAB and Tiller, both of which provide Bill Payment Tracker templates.

Which free Quicken option is the best?

Only a few free alternatives to Quicken are available. Personal Capital (Empower), as mentioned above, is the finest in my opinion. It is my best choice because of the way its features, usability, and user interface all work together.

The most important thing is to select an instrument that suits your needs. That’s Personal Capital to me. (Empower). But most people seeking to manage their money more effectively should find one or more of the aforementioned Quicken alternatives to be suitable.

Add Comment